The cost of occupying office space in the UK has stabilised in 2023, according to property consultancy Lambert Smith Hampton (LSH).

In its annual Total Office Cost Survey, LSH has analysed the total occupancy costs for offices in 54 key locations and revealed soaring costs across the board.

Across all the surveyed locations, the average cost of occupying a new-build office increased by 3.4 per cent over the over the 12 months to September 2023, dropping sharply from the record 12.4 per cent year-on-year increase recorded in last year’s survey.

Energy prices

Amid much sharper rises across other cost metrics, a near halving in energy prices was key to the relatively modest annual increase.

The effect of falling energy prices was felt even more keenly for typically less energy efficient 20-year old office buildings, with average total office costs across the 54 locations remaining stable over the past 12 months, having been subject to an 18 per cent annual increase in last year’s survey.

Of the 22 office cost metrics, changes in rents are usually the main determinant of overall total office cost movements from one year to the next. However, given high inflation and volatility in the energy markets, other costs associated with office use have had a stronger impact on overall costs over the past two years.

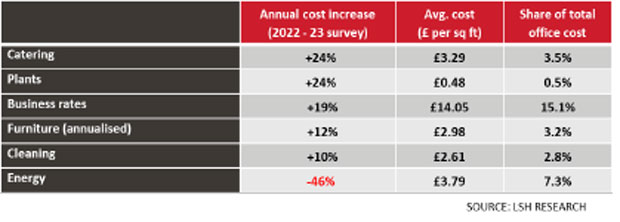

According to energy services provider ZTP, energy prices have fallen by 46 per cent from their peak at the time of last year’s survey. Despite the fall, current energy costs remain relatively elevated, accounting for 4.1 per cent of total office costs for a new-build office in the 2023 survey and comparing with an average of 2.8 per cent over the five years prior to last year’s energy crisis.

Increased business rates

While a sharp fall in energy prices helped to quell the rise in total office costs in 2023, significant upward cost pressure came from increased business rates liabilities. For new-build offices, rate liabilities increased by an average of 19 per cent since last year’s survey to account for 15 per cent of total office costs.

Top 5 cost increases across the 22 TOCS metrics

Flight to quality fuels strong rental growth

The latest survey also provided continued evidence of a clear flight to quality in occupier demand in the wake of the pandemic. Over the 12-month period, rents for new-build offices increased by an average of 6.8 per cent across the 54 locations, accelerating from 6.0 per cent growth in the preceding year and the strongest annual rise on the survey since 2015.

Meanwhile, rents for notional 20-year old buildings increased by a more modest 3.9 per cent on average since the last survey. While this is the strongest rate of growth since 2018, it was the fifth successive year that 20-year old buildings saw slower rental growth than new buildings.

However, the overall cost premium associated with new office buildings due to higher rents continues to be partly offset by the higher energy costs associated with less efficient 20-year old office buildings. Despite the sharp fall in energy prices since the peak in 2022, the new-build office cost premium over 20-year old buildings stands at only 11 per cent, significantly below the long-term average premium of 16 per cent.

Differing rates of rental growth and revised rate liabilities over the past year drove notable contrasts in overall office cost movements across the 54 locations. With regard to new buildings, Oxford saw the sharpest annual increase, with occupier costs rising by 14 per cent on the back of a substantial 26 per cent growth in prime rents and a 43 per cent rise in rates liabilities. Notably, Oxford (£113 per sq ft) and Cambridge (£114 per sq ft) are the only two locations outside of Central London to see total costs for new buildings move to above £100 per sq ft.

As ever, London’s core West End remains by far the UK’s most expensive office location, with the annual cost for a new office in Mayfair standing at £21,765 per workstation, 135 per cent above the UK average and 47 per cent ahead of the next most expensive location, the City of London. Both of these locations saw total costs for new build offices rise by over 10 per cent from last year’s survey fuelled by strong rental growth.